Introduction

As all of you know that due to the pandemic all the airline's companies have faced a huge loss and at this situation, we have known the company which was showing the profits from 47 years straight, So today we are going to talk about how this company stayed profitable in 2 fuel crisis, Great Recession (aka 2008 Recession), and most important 9/11 attacks. So let's get into the depth analysis of Southwest Airlines

Model of Operation

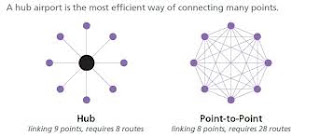

First. to get into the analysis of the legendry company we need to know how the airline's company connects their destination, The first model is the Spoke and hub distribution Model and the second model is the Point-to-point Model. In Spoke and hub distribution Model you create a Hub in between so that you can take people from point A to O and then from to their required destination, which is quite a time and fuel consuming so where in Point-to-point Model you Join all routes with different planes for which you need many planes.

In this situation, Southwest chose the best of all Southwest only serves to the place with the most traffic on point to point model as in point to point model there is less time used and as they are only serving the places with high traffic the fuel prices will be drastically down and there will be more profits coming up, by this Southwest got ton of cash flow to survive in the times of crisis.

Strategy:2

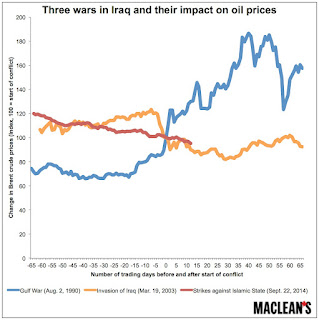

The second strategy Southwest uses is called Oil/Fuel hedging. The story dates back to 1990 when the Gulf War was at its peak and due to the war, the price of fuel went up by 100%. Now it's obvious that any change in fuel prices will directly impact the ticket prices, After the war was over the oil prices came down drastically.

At this time while other companies were enjoying profits, Gary Kelly(CFO at that time, Now CEO) took this event very very seriously as a history student he realized that the world is not too far from another oil crisis, So he decided to deploy a strategy called Oil hedging in simple word it's the insurance for fuels where southwest has made a deal to pay the higher price today so they can get fuels at the same price when at rising in fuel prices. For example, if the price of fuels is $20 per barrel southwest would pay $35 per barrel with the condition that if tomorrow the prices shot up to $60 per barrel they would still pay $35 per barrel. From 1994 southwest started hedging 20-30% of its fuel and up to 2001 southwest had already hedged 100% of the fuel, which also helped it to suffer the 9/11 attacks and the 2008 recession. And due to this oil saved Southwest 3.5 billion dollars from 1998-2008 which contributed to 83% of their profits in the same span.

Stragety:3

The third strategy of Southwest is Employee and customer satisfaction as bigger companies highly focus on its customer and Employee satisfaction southwest also does the same. All the great organizations divide their hardship such that all of them suffer some so that only one won't suffer like family. After 9/11 while all the employees of other airlines company had lost their jobs the CEO of southwest Jim Parker made a public announcement that "We don't know what the future holds, but know this: Your jobs are safe and we're going to keep issuing paychecks even though not a single plane is in the air".And as the customers are concerned many airlines made it very hard for the customers to get a refund but southwest gave no questions fully refund policy, What followed next was very wonderful the decision made the company to came together to take flights as soon as possible and the finance team focused on cut cutting, Insurances claiming and other focused on creating new flight schedules. Some worked 18-20hrs a day while others didn't take weekends and some customers gave a $1000 check to the company to make a contribution to the well-being of the company.

Conclusion

The lessons you need to learn from this case study are:

- You should not always try to fit on the industry's current standards.

- Make strategies that separate you from the rest of the competition.

- Be futuristic by seeing the past or present.

- Work hard in good times so that you can be ahead from the competition in the time of crisis.

- Focus on channelizing your profits.